Do you know the value of a customer?

At the risk of already creating a cliché in this very young marketing blog, the answer is “it depends.” Yeah, we’ll go there again. But it’s not as much of a “it depends” as usual, because there’s a relatively clear answer that we’ll give you.

It depends on your industry, profit margins, and what you want to achieve.

Why Does Knowing Customer Value Matter?

It matters because it helps inform your budget when developing a digital marketing strategy. If you don’t know how much a customer is worth, how would you know whether your campaign is doing well or needs to be improved? While it’s useful to set marketing goals, it’s even better to know what achieving those goals is worth.

Say you’re a local gardener servicing homes between Mornington and Mentone and want to start a Facebook campaign with an end of summer garden clean up.

How much should you spend on Facebook ads, including the cost of hiring a local marketing agency to do the work?

Let’s say, including agency and Facebook advertising fees, it costs $50 to get a new customer to book in a spring clean, but you also only charge $50 for the clean up.

This doesn’t sound very good…

But what if you also keep track of the lifetime value of a customer – how long does a customer stick around and how much money do they spend over that time?

While that initial sale is only worth $50, we all know a lot of people book in a regular gardening service. So maybe most of these new customers stick around for 12 months, spending on average $50 a month. Rather than only making $50 for the initial $50 investment, you’re actually making $600.

Sounds a lot better, doesn’t it?

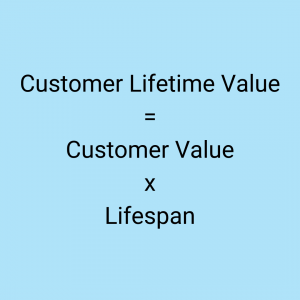

This is where customer lifetime value comes into play.

How To Calculate Customer Lifetime Value

As you can see from the simple example above, it’s easy to calculate the average customer lifetime value for you business if you know a few things.

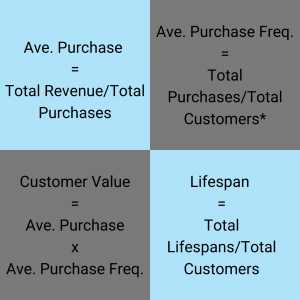

You need to know:

- The average purchase by a customer

- How often a customer purchases (on average)

- How long a customer stays a customer (on average)

*Over a specific period of time.

With all this information, calculating average customer lifetime value is easy.

It’s all pretty standard maths that’s easy to calculate. And you can factor in profit margin if needed.

This Information Should Inform Your Budget and Define Success

What’s a good cost per click for a Google Ads campaign? Is your agency too expensive or do they present value?

You don’t know this until you know how much a customer is worth, and you don’t know that without knowing customer lifetime value.

If the cost to acquire a customer is less than their value, that’s a good thing. And if you’re trying to determine a budget for a marketing campaign and whether it’s worthwhile, you can see why this is important.

Of course you always want to bring down your cost per acquisition, but that’s another story.